Modeling autocorrelation in financial time series:

•Volatility Clustering refers to the observation, first noted by Mandelbrot (1963), that “large changes tend to be followed by large changes, of either sign, and small changes tend to be followed by small changes. Vt=f(Vt-1, Vt-2…Vt-n)

•Volatility clustering are modelled by ARCH and GARCH models, which are also used to predict volatility changes.

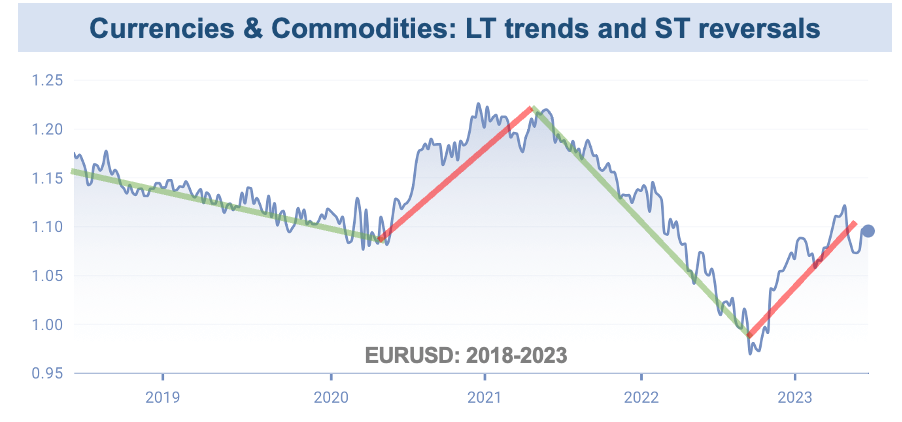

•Are returns autocorrelated?

•Positive correlation:

trending

•Trend-following is the predominant strategy of CTAs.

•Negative correlation:

reversal

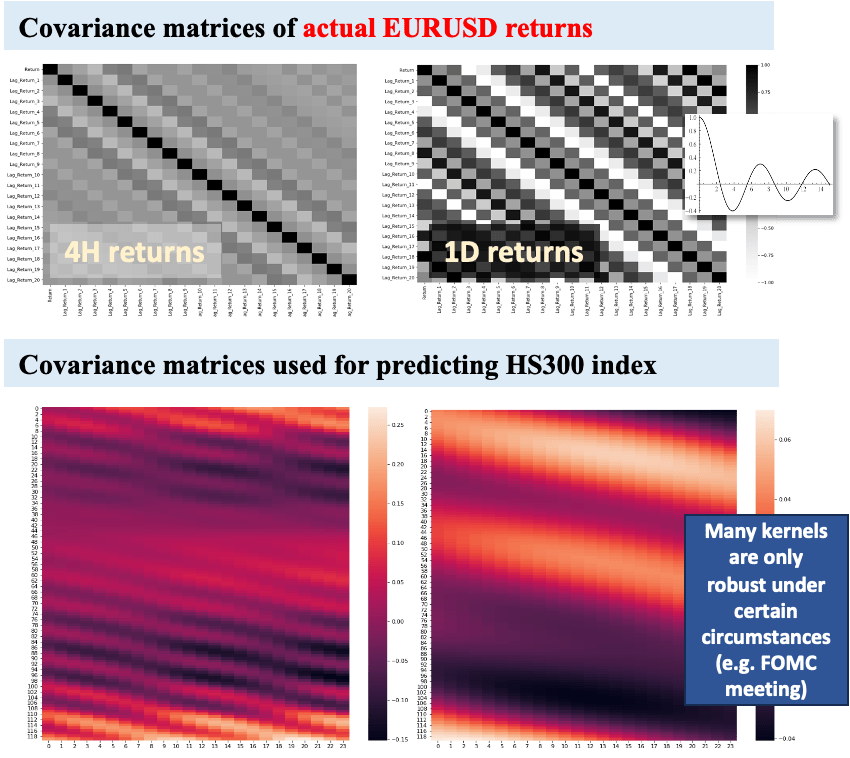

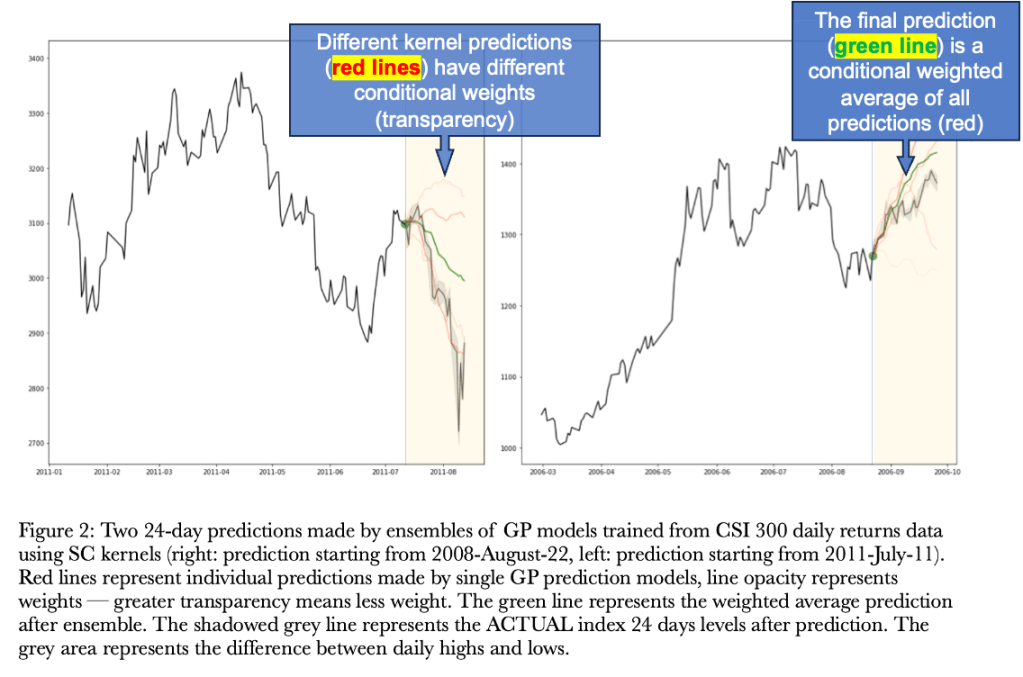

•Gaussian Process (GP) is one of the best machine learning tools for autocorrelation modelling

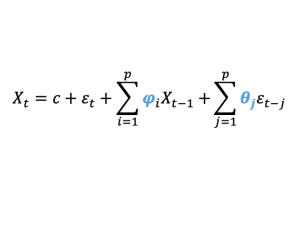

GP model can be expressed as an ARMA model:

•In GP, φ_i and θ_i ARE determined by the kernel function k and its hyperparameters.

•In standard ARMA model, φ_i and θ_i are NOT related mathematically.

•GP can be seen as a more restricted form of ARMA model, which aims to measure the mathematical structure underpinning serial correlation (using kernel function), rather than simply estimating the values of serial correlation.

•ARMA model can also be seem as a single-layer no activation layer RNN (Recurrent Neural Net) model. Standard RNN allows multi-level non-linear relations between past inputs and prediction, so it’s even more flexible than ARMA. It flexibility often cause serious overfitting problems in real-world applications, RNN are rarely used on financial time-series in practice.

•GP’s restrictiveness leads to more robustness and interpretability compared to other types of auto-correlation models.

Leave a comment